Underwriting a real estate property involves a detailed analysis of the property’s financial viability and potential risks. Here’s a step-by-step guide to help you understand the process:

1. Gather Property Information

Start by collecting all relevant details about the property:

- Property Address: Ensure the correct and complete address.

- Property Type: Identify if it’s residential, commercial, industrial, or mixed-use.

- Current Use: Understand how the property is currently being used.

- Physical Characteristics: Size, age, condition, number of units, and amenities.

2. Market Analysis

Evaluate the local market conditions to understand the property’s potential:

- Comparable Sales: Research recent sales of similar properties in the area.

- Market Rents: Determine the current rental rates for similar properties.

- Occupancy Rates: Look at the local occupancy trends.

- Economic Indicators: Review the area’s employment rates, population growth, and other economic factors.

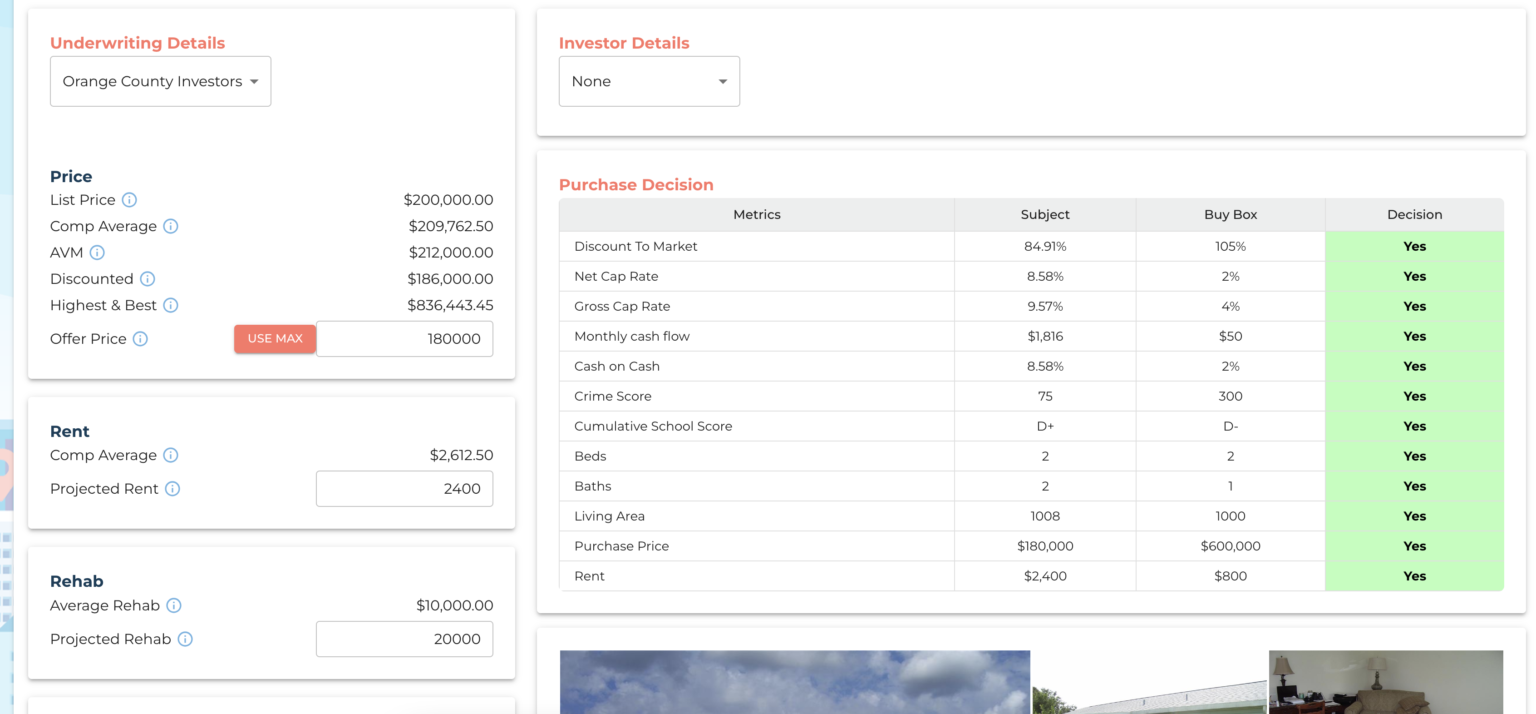

3. Income Analysis

Assess the property’s income potential:

- Current Rent Roll: Review the list of tenants, rental amounts, lease terms, and expiration dates.

- Market Rent vs. Actual Rent: Compare current rents to market rents to identify any discrepancies.

- Other Income: Include additional revenue sources such as parking, laundry, or storage fees.

4. Expense Analysis

Identify and evaluate all expenses associated with the property:

- Operating Expenses: Include property management fees, maintenance, utilities, insurance, property taxes, and repairs.

- Capital Expenditures: Account for major repairs and replacements that are not regular operating expenses.

- Reserves for Replacement: Set aside funds for future capital improvements.

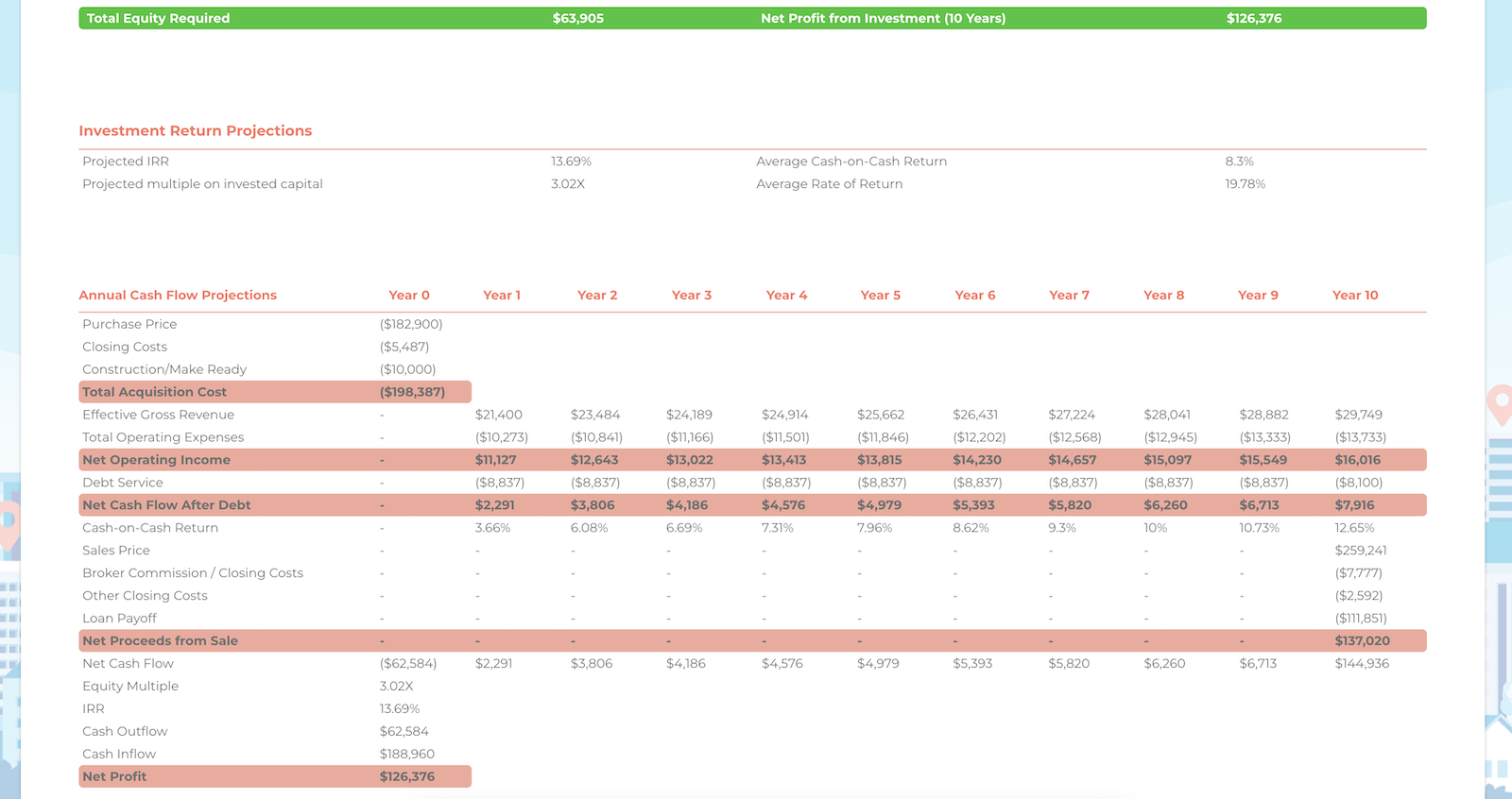

5. Net Operating Income (NOI)

Calculate the property’s NOI:

![]()

6. Financing Analysis

Understand the financing terms and their impact on the property:

- Loan Terms: Review interest rates, loan amount, amortization period, and any balloon payments.

- Debt Service Coverage Ratio (DSCR): Calculate DSCR to ensure the property generates enough income to cover debt payments.

- Loan-to-Value Ratio (LTV): Determine LTV to understand the loan amount relative to the property’s value.

7. Valuation

Determine the property’s value using various valuation methods:

- Sales Comparison Approach: Compare the property to recent sales of similar properties.

- Income Approach: Use the income capitalization method, where the property value is the NOI divided by the capitalization rate (cap rate).

![]()

- Cost Approach: Calculate the cost to replace the property minus depreciation.

8. Sensitivity Analysis

Conduct a sensitivity analysis to understand how changes in key assumptions impact the property’s financial performance:

- Rent Growth: Assess the impact of different rent growth rates.

- Occupancy Rates: Analyze the effect of changes in occupancy.

- Expense Variations: Evaluate how fluctuations in expenses affect the NOI and overall profitability.

9. Risk Assessment

Identify potential risks and mitigation strategies:

- Market Risks: Economic downturns, changes in local market conditions.

- Property-Specific Risks: Structural issues, tenant default risk.

- Financial Risks: Interest rate changes, refinancing risks.

10. Create Report

Summarize the findings in an underwriting report:

- Executive Summary: Key findings and recommendation.

- Detailed Analysis: Comprehensive details of all the steps and calculations.

- Supporting Documents: Include rent rolls, financial statements, market reports, and other relevant documents.

Bold Street

Here’s the good news. Bold Street does all this for you automatically. Why go through these steps to manually underwrite a property, when you can use a platform to do it for you?

Start your free trial today. No credit card required.